[ad_1]

PayPal this week laid out its imaginative and prescient for the way forward for its digital wallet platform and its PayPal and Venmo apps. During its third-quarter earnings on Monday, the corporate stated it plans to roll out substantial adjustments to its cellular apps over the following yr to combine a variety of recent options including enhanced direct deposit, examine cashing, budgeting instruments, invoice pay, crypto assist, subscription administration, purchase now/pay later performance, and all of Honey’s purchasing instruments.

While PayPal had spoken prior to now about bringing Honey’s capabilities into PayPal, CEO Dan Schulman detailed the integrations PayPal has in retailer for the deal-finding platform it purchased final yr for $four billion, in addition to a agenda for each this and the opposite app updates it has in retailer.

The Honey acquisition had introduced 17 million month-to-month energetic customers to PayPal. These customers turned to Honey’s browser extension and cellular app to search out the perfect financial savings on objects they need to purchase, monitor costs and more.

But at this time, the Honey expertise nonetheless stays separate from PayPal itself. That’s one thing the corporate desires to vary subsequent yr.

According to Schulman, the corporate’s apps shall be up to date to incorporate Honey’s purchasing instruments like its Wish List function that permits you to monitor objects you need to purchase, value monitoring instruments that provide you with a warning to financial savings and value drops, plus its offers, coupons and rewards. These instruments will develop into a part of PayPal’s checkout answer itself.

That means the corporate will be capable to monitor the client from the preliminary deal-hunting part the place they’re indicating their curiosity in a sure product, goal them with financial savings and gives, then information them via its checkout expertise multi functional place.

PayPal will even present “anonymous demand data” to retailers primarily based on client engagement with Honey’s instruments to assist them drive gross sales, the corporate stated.

What’s more, PayPal put timeline on the Honey integrations and the opposite updates it plans to roll out over the course of the following yr.

Bill Pay will begin to roll out this month, PayPal stated, with a big redesign of the digital wallet expertise anticipated for the primary half of 2021. Much of the brand new performance shall be arriving within the second quarter and the second half of the yr, with a purpose of getting nearly all of the adjustments rolled out by the top of subsequent yr.

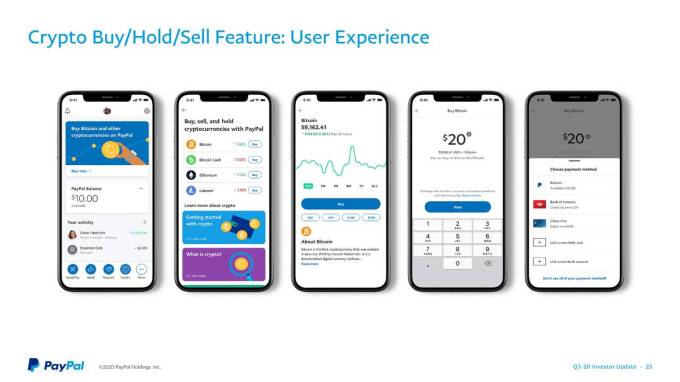

This additionally consists of PayPal’s plans for cryptocurrencies, introduced on the finish of October. The firm goals to assist Bitcoin, Ethereum, Bitcoin Cash and Litecoin at first, initially within the U.S.

Speaking to buyers in the course of the earnings name, Schulman additionally famous when PayPal plans to deliver crypto to more customers and geographies. He stated the power to purchase, promote and maintain cryptocurrencies will first arrive within the U.S., then will roll out to worldwide markets and the Venmo app within the first half of subsequent yr. (Currently, PayPal is providing U.S. customers to affix a waitlist for the brand new crypto options in-app).

Image Credits: PayPal

This change will permit PayPal’s customers to buy utilizing cryptocurrencies throughout the corporate’s 28 million retailers with out requiring further integrations on retailers’ half. The firm defined this is because of the way it will deal with the settlement course of, the place customers will be capable to instantaneously switch crypto into fiat foreign money at a set price when testing with PayPal retailers.

PayPal additionally not too long ago joined the “buy now, pay later” race with its new “Pay in 4” installment program that lets shoppers cut up purchases into four funds. This debuted in France forward of its late August U.S. launch and has since rolled out to the U.Okay. (as Pay in 3). This too, will develop into more built-in into the corporate’s apps within the months forward.

Venmo — which the corporate expects to achieve $900 million in revenues subsequent yr — will see the growth of enterprise profiles, and will achieve crypto capabilities, more fundamental monetary instruments and purchasing instruments, in addition to a revamp of the “Pay with Venmo” checkout expertise.

Schulman referred to the corporate’s plans to overtake its Venmo and PayPal apps as a “fundamental transformation,” because of how a lot new performance they may embody because the adjustments roll out over the following yr in addition to the brand new person expertise — mainly, a redesign — that can permit individuals to maneuver simply from one expertise to the following as an alternative of getting to vary apps or use a desktop browser, for instance.

PayPal’s earnings hadn’t excited Wall St. buyers this week, sending the inventory down on its lack of 2021 steering. But the yr forward for PayPal’s digital wallet apps seems to be an attention-grabbing one.

[ad_2]

Source